Hoang Hai Yen & Le Thi Minh Doan

- Hoang Hai Yen1

University of Social Sciences and Humanities – Vietnam National University Ho Chi Minh City - Le Thi Minh Doan2

SP Jain School of Global Management, Australia

Abstract

The Coronavirus disease, caused by the novel coronavirus (as known as SARS-CoV-2) has affected people all around the world. The pandemic has changed people’s behavior, including online shopping through e-commerce platforms, apart from the increase in trend of e-learning, IT start-ups, social media, etc. The dominant explanation for this trend is social distancing preventing transmission. Both Korea and ASEAN all witnessed significant positive changes in the digital industry, particularly in e-commerce, hinting at a timely opportunity for strengthening the digital relationship between both sides.

ASEAN and Korea have been developing close cooperative ties with one another in the past 30 years. Given the impact of COVID-19, Korea, and ASEAN member states underlined the need to collaborate post-pandemic in potential areas such as digital technology, digital economy, and cybersecurity. This essay will focus on one of the most potential areas in the Korean – ASEAN relationship post-COVID-19 era: digital partnership.

Korea’s E-commerce market ranked fifth in the 2019 global ranking, with an impressive $103.48 billion in E-commerce sales. The Korean government has been encouraging launching new E-commerce applications, platforms, and payment solutions. Logistics and efficient delivery services are the main factors driving growth in the domestic E-commerce market, with orders being delivered within 24 hours. Meanwhile, consumers in ASEAN are also leaning towards buying online, with their spending predicted to triple from US$125 to US$390 in 2025. ASEAN e-commerce rising fast thanks to the region’s growing middle class, major online marketplaces emerging, and social media-savvy people. Despite its constant growth, there are still barriers to ASEAN e-commerce, with an example being skepticism regard the reliability of online payment method.

In this essay, there are 3 main recommendations made for strengthening the e-commerce partnership between Korea and Southeast Asian countries post COVID-19 era. Firstly, fintech is expected to be the greatest contribution to this e-commerce partnership. In Asia, where there is still a high portion of consumers who do not own credit, debit cards, or bank accounts, fintech offers them alternative methods of payment. Not having to pay a hefty cost over the top in international transactions will also encourage buyers and sellers from Korean and ASEAN countries. Besides, fintech helps target the right ads to the right customers by collecting and analyzing customer data using algorithms.

Secondly, to make sure the e-commerce partnership between Korea and ASEAN reaches its highest potential post-COVID-19, a specialized E-commerce Training Program for Talents from Korea and ASEAN is suggested. This is a challenging 6-month rotational program, including international assignments, real-world skills development, coaching and mentoring, network expansion, and performance evaluation.

Establishing a scholarship program to study at universities in Korea with the training of relevant disciplines for students from ASEAN universities is the final recommendation. The talents from ASEAN who wish to pursue a further study related to the e-commerce industry in a Korea University will be given full financial support. Those who are awarded this scholarship, however, must commit to contributing to their countries. The scholarship obligation will include the requirement of 3 years working for a Korean entity after study completion as a way to contribute to the Korean e-commerce industry.

Introduction

The Coronavirus disease, which is caused by the 2019-novel coronavirus (as known as SARS-CoV-2) has affected the lives of billions of people all around the world since the first infected cases were found at Wuhan, China in December 2019 (Zheng, 2020). It not only has created a severe health crisis but also has been a terrible blow that afflicts, without exception, the whole global economy.

On that gloomy picture, the pandemic, on the other hand, has opened a new era for the digital industry. In the context of the pandemic, as people began social distancing, as well as working or schooling from home due to government lockdowns, many people have changed their shopping behavior. Instead of buying food or necessities in physical stores or markets like in the past, consumers now tend to start shopping online in greater numbers and frequency. This, therefore, has helped the e-commerce industry grow considerably amid the pandemic, expected at nearly 20% in 2020 (Haller et al., 2020).

There is no universally agreed definition of the term e-commerce and what it comprises. However, generally speaking, E-commerce or electronic commerce is considered as the act of buying and selling goods or services conducted via virtual marketplaces or online channels. Yet, the payment and shipment can be made through offline channels. It is not until the pandemic broke out that the term e-commerce started to be known widely to the public. However, the pandemic has worked as a catalyst, as it has made the process faster and pushing the industry ahead by roughly five years (Haller et al., 2020). Therefore, there is no other time more appropriate than now for countries, those are having e-commerce advancement as one of their core strategic economic development plans to take this chance and put plans into action. And like Hellen Keller, an American author, once said: “Alone we can do so little, together we can do so much”, if nations unite for one purpose, a new chapter of greater prosperity will begin for all.

With that spirit expressed through the motto “unity in diversity”, ASEAN, established in 1967, has managed to develop economic ties with many countries and organizations in the world, including Korea. The ASEAN-Korea partnership started in 1989 and has now become a strategic partnership. Mutual understanding and trust have helped the two sides find a common voice to join hands in many fields, especially digital partnership establishment, including e-learning, IT startup, etc. and e-commerce. Lying within the flow of the world in the COVID-19 era, the e-commerce industry in Korea and ASEAN countries has accelerated continuously and is projected to grow into one of the leading cooperation areas between Korea and ASEAN countries during and after the pandemic.

ASEAN’s rapid e-commerce market growth, with the rise of internet connections and the digital integration framework being put in place, as well as Korea’s advanced e-commerce background are opportunity factors for both sides to bolster the partnership and together achieve even better results in the economic development in general, and the e-commerce industry in particular. Therefore, it is necessary to seek ways to advance into strategic research targets and present effective action plans.

The purpose of this paper is to analyze the current status of e-commerce in Korea and ASEAN, including prospects of e-commerce’s development in the post-COVID-19, as well as the strengths and challenges of each side, through which plans and strategies are presented for both Korea and ASEAN to promote.

ASEAN-Korea Partnership Overview

ASEAN and Korea have been developing close cooperative ties with one another. The relationship between ASEAN and Korea in the past 30 years is significant, with South-East Asia countries being Korea’s second-biggest trading partner. Korea spent an enormous amount of investment on ASEAN as it is in Korea’s top 2 international construction market (Jaehyon, 2019). Korea is also increasingly introducing its culture to ASEAN countries, with mutual visits consists of over 10 million people in 2018.

The New Southern Policy (NSP) centered on People, Prosperity, and Peace – one of the significant foreign policies under President Moon term – was introduced in 2017, focusing on its cooperation with ASEAN. President Moon Jae-in is the first president who has visited 10 ASEAN member states within the presidency term (Kwak, 2020). A cooperative relationship has been developed from both sides in many areas, not limited to economics but also human and cultural exchange. However, COVID-19 is a disruptive factor for all governments in the future. To remain relevant to ASEAN member states, a strong emphasis on digital partnership in the next phase of the NSP would be very critical in this scenario. The sharing of COVID-19 related best practices, experiences, and technology by Korea with ASEAN countries in the new era of digital partnership could also fall under the NSP.

In November 2019, the ASEAN-ROK Special Summit and the 1st Mekong-ROK Summit presented a hopeful vision regarding the ASEAN-Korea relationship for the next 30 years (Kwak, 2020). Both sides have shown their commitment to strengthen ASEAN-ROK relations in the coming years. South Korea has actively given support to ASEAN members in mitigating the impact of COVID-19, contributing to the Covid-19 ASEAN Response Fund.

Given the impact of COVID-19, South Korea, and ASEAN member states underlined the need to collaborate post-pandemic in potential areas such as digital technology, digital economy, and cybersecurity. The areas of mutual interest like trade and investment, disaster management, connectivity, smart city, and infrastructure are to be discussed by both sides (Jaehyon, 2019). This paper will focus on one of the most potential areas in the Korea-ASEAN relationship post-COVID-19 era: digital partnership. By joining forces, Korea and ASEAN can draw upon each other’s expertise and together work on new ideas and innovations, reaching broader audiences and expanding markets.

The first country from ASEAN launching negotiations regarding the digital partnership with the Republic of Korea is Singapore. A new Korea-Singapore Digital Partnership Agreement (KSDPA) has been signed on 22 June 2020. Both sides agree there should be meaningful cooperation in new emerging digital areas, including personal data protection, fintech, and artificial intelligence to name a few (“Singapore, South Korea ink Digital Partnership Deal”, 2020). Both countries’ SME communities are expected to work side by side and support each other in the digital economy. The digital partnership will enable greater access, connectivity, and opportunities between each country’s residents and companies. To make use of human and other international resources in the new digital era, Korea should consider expanding a similar agreement with other countries from ASEAN. E-learning, IT startup, social media, especially e-commerce, can be the new focus in the partnership between Korea and ASEAN.

A Look at E-commerce Industry in Korea

Korea’s e-commerce market ranked fifth in the 2019 global ranking and is the third biggest e-commerce market in Asia after China and Japan with $103.48 billion in e-commerce sales (Lipsman, 2019). According to a report on Korea’s online shopping trends in August, 2020 released by Statistics Korea, domestic online purchases (B2C) reached KRW14.3833 trillion, marking a rise of 27.5% percent of a year earlier and a 10.8% on-month increase. Especially, the transaction amount of mobile shopping reached KRW9.26 trillion (accounting for 64% in online shopping transactions), increasing 27.8% compared to the same month last year. The first half of 2020 also saw a steady increase in purchases on food service, food, and beverage, household items, home appliances & electronic, but a dramatic drop in purchases on travel & transportation services, culture & leisure services.

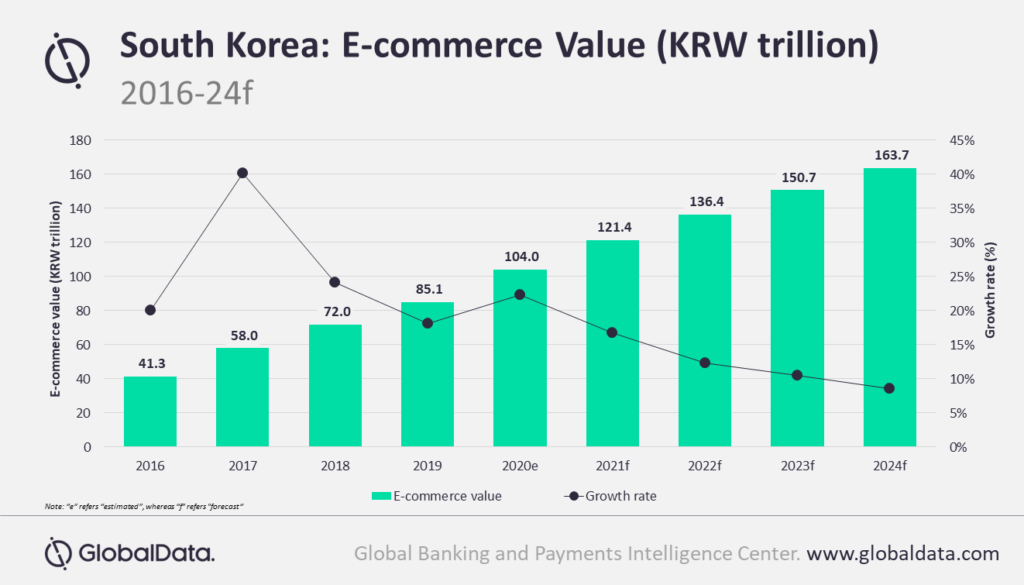

An analysis of GlobalData’s E-commerce Analytics demonstrates that the country’s e-commerce market is estimated at KRW104.0 trillion with annual growth of 22.3 percent in 2020. It is also expected that the market will reach KRW163.7 trillion in 2024. Hence, the growth will be maintained albeit at lower rates.

Source: GlobalData

Korea defeated some of the strong opponents in the ranking, largely in part thanks to Korea’s well-established ICT infrastructure, including internet connectivity, PC & smartphones, and other open innovation of digital infrastructure. In 2019, there were 46.35 million internet users in Korea or almost 90% of the population (Waldeck, 2020). Korea is also known to have the highest average internet connection speed in the world – 24.6Mbps (Belson, 2017). Moreover, people can access high-speed Wifi everywhere in Korea, even on public transportations.

The growth of Korea’s domestic e-commerce industry is also supported by the extremely high mobile phone penetration rate. According to a report published by Statista, in 2019, 36.14 million people or 93.6 percent of the population in Korea used a smartphone and it is expected that the rate will reach 97.4 percent in 2025. One of the biggest advantages of smartphones is that they are not restricted by time or space to be used. Therefore, the size of mobile shopping, which has appeared as a new distribution channel for e-commerce, has increased significantly. Besides, the Korean government has been invested in preparing and carrying out development strategies for the information and technology sector, including encouraging launching new e-commerce applications, platforms, and payment solutions. Along with that, the competition between IT businesses, typically fintech companies, to enter the e-commerce industry has diversified the payment methods, making payments simpler, contactless while still ensuring high user information security.

Popular Korean e-commerce platforms include “Coupang”, “Gmarket”, “Ticket Monster” (TMON), “11th Street” and “Auction”, on which Korean consumers purchase food and beverages, apparel, electronics, cosmetics, or personal care items. Additionally, several e-commerce mobile platforms target specific customers with particular types of products, such as clothing, food, etc. Logistics and delivery services are also key drivers of the growth in the e-commerce market within Korea. Customers have various ways to receive their packages, and the delivery time is usually within 24 hours due to the dense population concentration in Korea’s metropolitan areas.

However, Korea’s e-commerce market in the post-COVID-19 era also has to face some of the challenges, such as lack of skilled workers due to the declining working-age population, fierce competition with the largest economies in the world, or supply decrease/supply chain delays due to cataclysm such as natural disasters, epidemics, etc.

A Look at E-commerce Industry in Southeast Asia

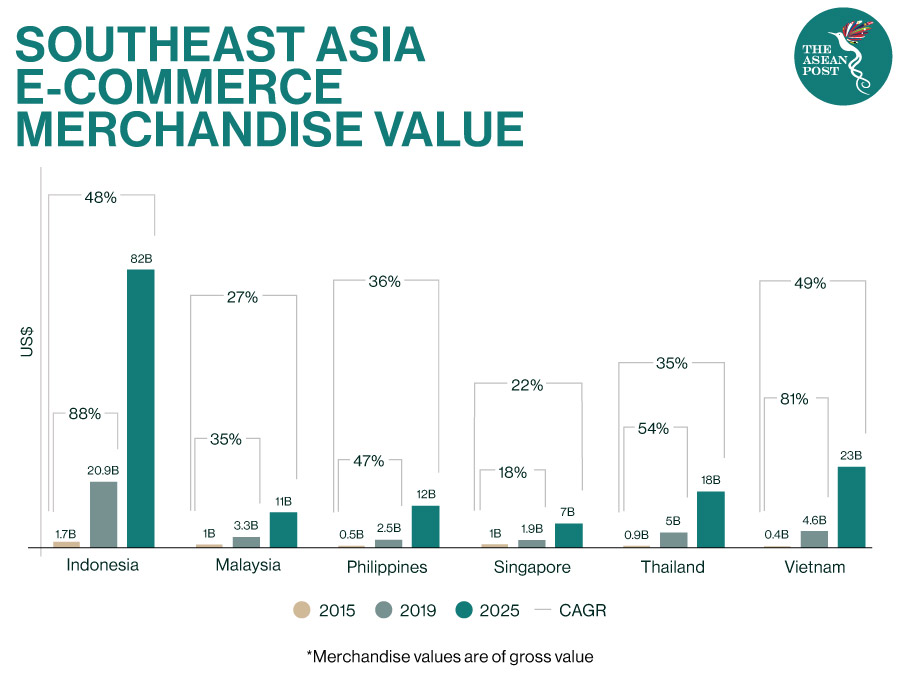

Consumers in ASEAN are leaning towards buying online, with their spending predicted to triple from US$125 to US$390 in 2025, as Bain & Company predicted in 2019 (“Fast-Changing E-Commerce Trends In A Pandemic”, 2020). Better internet access is the main factor driving 310 million digital consumers by 2025, an addition of 60 million compared to 2018. In a recent survey conducted across ASEAN’s six biggest economies – Indonesia, Malaysia, Philippines, Singapore, Thailand, and Viet Nam, more than 90 percent of the respondents use smartphones to connect to the internet, creating new opportunities for e-commerce players (“Fast-Changing E-Commerce Trends in a Pandemic”, 2020).

ASEAN e-commerce rising fast thanks to the region’s growing middle class, major online marketplaces emerging, and social media-savvy people. Recently, international e-commerce platforms have invested heavily in local online marketplaces (Shopee and Lazada Group are two examples), accelerating the growth of e-commerce across ASEAN. When it comes to social media, Facebook, Instagram, and Google are at the top in digital ad selling in the region. The final positive factor benefiting ASEAN e-commerce is the number of middle-class households being predicted to more than quadruple to 161 million by 2030 (“E-commerce in ASEAN: A Guide for Australian Businesses”, 2019).

Despite its constant growth, there are still barriers to ASEAN e-commerce. Unclear regulatory requirements appear to be disadvantaged. An example is an e-commerce trust mark displayed on the e-commerce website to prove its trustworthiness by the issuing organization (such as TRUSTe and VeriSign) (“E-commerce in ASEAN: Seizing Opportunities and navigating Challenges”, 2018). However, consumers in some of the developing countries in ASEAN do not find trust mark reliable. When it comes to payment methods, customers and retailers are still skeptical about any security and reliability of the transactions done online and are more confident with cash transactions. Lack of information and public awareness are the main cause of the mentioned wariness. Unique last-mile delivery challenges are also part of the challenges. In the Philippines and Viet Nam, shipping to the rural areas can be problematic. Only 53 percent of Indonesian residents live in metro areas, causing huge logistical issues (“E-commerce in ASEAN: Seizing Opportunities and navigating Challenges”, 2018).

Source: The ASEAN Post Team

In the week of March 22, in the middle of the pandemic, the number of shopping apps downloading in Thailand surged by 60%, according to App Annie firm. Indonesia, Viet Nam, and Singapore, which were under the very same scenario, each recorded a 10% increase in weekly downloads (Kang, 2020). People were staying at home and spending significantly more on online shopping.

COVID-19 has completely changed the way consumers spend on grocery products. People started stockpiling everyday goods, especially those that come from value and trusted brands online. Apparel and consumer electronics sales fell significantly. In six Southeast Asian countries, 47% of consumers avoided in-store buying, 30% spending more on online shopping (Yendamuri et al., 2020).

People are increasingly going online to buy necessities such as groceries, clothes, and personal care items, not only discounted electronics products like before, especially during the COVID-19 pandemic (Yendamuri et al., 2020). Of 4 popular e-commerce players in the area, Shopee Vietnam is the only one that witnessed their website traffic improved quarter over quarter. Tiki, Lazada Vietnam, and Sendo all had their traffic dropped by nine percent compared to the same quarter the previous year.

In February, when the virus was detected in Viet Nam for the first time, customers’ demand for healthcare products increased by an enormous amount of 610 percent and 680 percent compared to the previous month (Yendamuri et al., 2020). By March, as consumers stayed home to comply with social distancing rules, other online groceries were also searched for more. The surprising downward movement in the ASEAN e-commerce industry is a result of fast-changing trends and the unpredictable demand amid COVID-19. This poses a new threat for e-commerce businesses, but also hint at the possible potential in the upcoming months.

Recommendations For Strengthening E-commerce Partnership Between Korea and ASEAN In The Post-COVID-19 Era

Fintech – Solution for Fast, Secure Payment and Data Analysis

For key players in the e-commerce industry in Korea and ASEAN to collaborate effectively post the COVID-19 era, fintech is the greatest contribution to this e-commerce partnership, altering and improving the online payment system. Fintech has already affected online shopping to a significant degree with e-wallets, peer-to-peer payments, and in-app purchasing have been introduced. In southeast Asia, where there is still a high portion of consumers who do not own credit, debit cards, or bank accounts, fintech offers them alternative methods of payment. Taking advantage of the fast and secure payment platforms provided by fintech has helped e-commerce speed up their sales by overcoming the fear of hassle and untrustworthiness from the customer side. The troublesome process of creating and maintaining a bank account is now replaced by quick digital wallets. Customers do not have to worry about their credit card information stolen by a third party. This led to a steady increase in online purchase, incentivize sellers, and consumers to be more active, and built a strong foundation for the cross border e-commerce between Korea and members of ASEAN. Also, health concerns raised by COVID-19 have made cash-in-hand payment less practical, leading to an opportunity in digital payments and e-wallets. Due to concerns that handing over money can cause transmission of the virus, people now are leaning towards cash-less payment more and more.

Given that existing methods for transferring money internationally are complicated and not consistent, both sellers and payers are hesitant to be involved with currencies, regulations, markets, risks, and systems (“A Game-changer for Cross-border Payments”, 2019). Having to pay a hefty cost over the top in transactions between Korea and ASEAN countries will also discourage these two parties. Fintech is the most timely and appropriate solution to push sales and incentivize people to be more active on e-commerce platforms. An example is BlueSnap, an online payment solution offering global payments in 100 local currencies and over 110 trusted payment types (Marchese, 2017). The ability to offer various payment methods worldwide is what makes such firms an integral part of cross border e-commerce.

Last but not the least, fintech has left a significant impact on e-commerce using its ability to collect customer information through different apps and services. The data then is run through analytics and artificial intelligence algorithms to find out the purchasing patterns (“The Impact of Fintech on eCommerce”, 2017). This will be incredibly beneficial for e-commerce platforms that want to target international customers since the data will help them direct suitable ads towards potential buyers. This increases sales possible since buyers tend to purchase the products that they have already viewed and shown interest in. In a post-COVID-19 world where face to face contact is restrained, if Korean e-commerce platforms want to expand their market to ASEAN, using fintech to analyze customer data will save a lot of time and money spent on traditional market research. Besides, the rise of e-commerce industry in the region also calls for the increasing need for fast and secure payment methods, which can be an opportunity for Korean fintech companies to enter the market and expand their business.

Specialized E-commerce Training Program for Talents in the Region

To make sure the e-commerce partnership between Korea and ASEAN reaches its highest potential post-COVID-19, the employees need to be equipped with appropriate skills, cultural knowledge, and aptitude to perform operations. The suggested specialized E-commerce Training Program for Talents from Korea and ASEAN offers a powerful and unique experience for top performers in the industry to build a leadership career. It should be built as a challenging 6-month rotational program, designed to develop e-commerce leaders who will position their country for industry growth while at the same time investing heavily in their knowledge and skills for success. The program is expected to expose participants to many aspects of e-commerce including e-commerce planning and analysis, pricing, investment decision-making, branding and communication, sales and channel management, and risk management. As potential leaders in the industry, the participants will take part in a variety of challenging and exciting experiences including:

International Assignments: This provides on-the-job learning and helps to develop a wide breadth of e-commerce industry and cultural knowledge. Participants gain invaluable practical experience by completing assignments in different countries in the region.

Real-world Skills Development: There is a variety of learning and sharing events to develop leadership effectiveness and soft skills for the participants to take part in. The structured courses taught by senior e-commerce leaders from Korea and other ASEAN countries will help to bridge the gap between school-based learning and application in the industry.

Coaching and Mentoring: Each participant of the specialized development program is paired up with an experienced mentor working in the industry, who assists the mentee in developing professionally as well as cultural skills and knowledge that will enhance leadership and personal growth. This mentor will also help to answer the everyday questions from the mentee.

Network Expansion: Building and maintaining mutually beneficial relationships is the key to launching a successful e-commerce partnership between Korea and ASEAN. Participants from different backgrounds with different experiences will get a chance to network with other creative talents from other countries. This is also a top benefit given to program participants to build international working relationships with others in the industry.

Performance Evaluation: During the program, to help the participants to keep track of their progress, they are rated and given continuous feedback through the one-on-one session and formal performance evaluations every 2 weeks.

An effective international training program is a timely solution suggested to accelerate the result of the e-commerce partnership between Korea and ASEAN countries. After COVID-19, all countries are affected heavily, and are people are leaning towards online buying. This is the chance to learn from our peers and improve. A perfect training and development program is one where employees can teach others something they know. Not only does this help with skill development, but it also provides room for international talents working in the e-commerce industry to understand each country’s values and culture on a deeper level. Besides, participants benefit from intensive training, leadership development, mentoring program, and potential close and lasting bonds in the industry.

Funding Scholarships for Nurturing Talents in the Industry

ASEAN countries have the advantage of cheap labor costs, but the lack of well-trained professionals is one of the reasons for poor adoption of e-commerce because Ecommerce is an industry based on high-speed information and communication networks, and other digital infrastructure, which requires a skilled workforce that knows online transactions and related technology to operate effectively. This leads to the urgency of fostering high-quality e-commerce human resources in the region.

To foster the education and training of experts in the e-commerce industry, Korea and ASEAN countries could sign an agreement on e-commerce training cooperation. This agreement includes improving facilities and subsidized research studies at ASEAN universities, as well as establishing a scholarship program to study at Korean universities with the training of relevant disciplines/courses for students with excellent academic records from ASEAN universities. The mission of this scholarship program is to find talents, develop them further, and provide them with rewarding opportunities so that they can lead and advance the development of e-commerce in their origin countries. This scholarship will provide full financial support for ASEAN students pursuing a postgraduate program at Korea’s universities with e-commerce relating fields of study such as e-commerce studies, information technology, marketing, logistics etc. The students who get this scholarship must demonstrate a desire to excel in research and to return to their hometown to contribute meaningfully to their countries. The scholarship also includes the requirement of 3 years working for a Korean entity.

For example, if a Vietnamese student receives the scholarship after he/she finishes his/her postgraduate program in a Korean university and works 3 years for a Korean e-commerce company, he/she is expected to return to Viet Nam within one year and contribute to the e-commerce industry in Viet Nam by working or serving for either a Vietnamese public/non-profit university or research institute or an e-commerce company, for the number of years of support that he/she receives from the scholarship.

Conclusion

The COVID-19 global pandemic has accelerated the adoption of digital technologies and services. One of the high tech-driven industries that are expected to continue surging in the post-COVID-19 era is e-commerce. The e-commerce market has grown rapidly as non-face-to-face lifestyles such as telecommuting and social distancing have become prevalent due to lockdowns. The competitive landscape in the e-commerce market is also changing. Now more than ever countries are constantly looking to new technology advancement and partnership with other countries to increase their influence in the global market towards the post-COVID “new normal”.

Based on their long-term relationship, Korea and ASEAN have actively strengthened their cooperation on digital partnership, especially the e-commerce sector. With well-developed ICT infrastructure such as high internet connectivity and smartphone penetration, as well as innovative digital solutions, Korea has emerged as one of the front-runners in e-commerce. But the competition in the global e-commerce market and big events like the COVID-19 pandemic have played as a game-changer and Korea is thus urged to expand its alliance with other countries to remain the growth momentum. Meanwhile, ASEAN is one of the most potential e-commerce markets with some of the key factors such as the growing middle class, the presence of major online marketplaces, and a social media-savvy population. Yet, improvements are still required in terms of ICT infrastructure, especially payments and data security solutions, along with talent nurturing programs/policies.

Therefore, this paper puts forward some recommendations for Korea and ASEAN to formulate and implement practical actions to take advantage of their strengths and solve the existing problems. One of these is to advance into the fintech segment to alter and improve the online payment system, as well as assure stronger data privacy protection. The other ones are providing E-commerce Training Program for talents from Korea and ASEAN, along with funding scholarships for nurturing young e-commerce talents.

However, challenges lay in every aspect of progress. Some challenges that have become barriers stopping Korea and ASEAN to realize the above demonstrated cooperating measures comprise consumers’ lack of trust in online transactions, in terms of product reliability and safety of payment mechanisms (DBS, 2015); the slow growth of ICT infrastructure ready for the wave of well-trained e-commerce professionals which may lead to “brain drain”; difficulty in raising public awareness and changing the long-standing perception on online businesses.

References

A Game Changer for Cross-border Payments. (2019). Retrieved from http://www.bbc.com/storyworks/future/the-new-rules-of-money/a-game-changer-for-cross-border-payments

Belson, D. (Ed.). (2017). The State of The Internet Q1 2017 (Rep.). Retrieved from http://www.akamai.com/fr/fr/multimedia/documents/state-of-the-internet/q1-2017-state-of-the-internet-connectivity-report.pdf

DBS. (2015). Ecommerce in Asia: Bracing for Disruption. Sector Briefing, No. 13. Retrieved from http://www.dbs.com.sg/treasures/aics/pdfController.page?pdfppath=/content/article/pdf/AIO/151103_insights_e_commerce_in_asia_bracing_for_digital_disruption.pdf

E-commerce in ASEAN: A Guide for Australian Businesses. (2019). https://www.austrade.gov.au/news/latest-from-austrade/2019-latest-from-austrade/online-marketplaces-unlock-export-opportunities-in-asean

E-commerce in ASEAN: Seizing Opportunities and navigating Challenges. (2018). Retrieved from https://www.edb.gov.sg/en/news-and-events/insights/innovation/e-commerce-in-asean-seizing-opportunities-and-navigating-challenges.html

GlobalData (2020). COVID-19 accelerates E-commerce Growth in South Korea, says GlobalData. Retrieved from https://www.globaldata.com/covid-19-accelerates-e-commerce-growth-south-korea-says-globaldata/

Haller, K., Lee, J., & Cheung, J. (2020). Meet the 2020 Consumers Driving Change (Rep.). IBM. Retrieved from https://www.ibm.com/thought-leadership/institute-business-value/report/consumer-2020

Jaehyon, L. (2019). 30 Years of ASEAN-Korea Partnership: From Prosperity to Peace with People. Retrieved from http://en.asaninst.org/contents/30-years-of-asean-korea-partnership-from-prosperity-to-peace-with-people/

Kang, S. C. (2020). COVID-19 whets Appetite for E-commerce in Southeast Asia, but Bottlenecks remain. Retrieved from https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/covid-19-whets-appetite-for-e-commerce-in-southeast-asia-but-bottlenecks-remain-57985529

Kwak, S. (2020). Planning The Future of Korea’s New Southern Policy. Retrieved from https://www.eastwestcenter.org/publications/planning-the-future-koreas-new-southern-policy

Lipsman, A. (2019). Global Ecommerce 2019 (Rep.). Retrieved from https://www.emarketer.com/content/global-ecommerce-2019

Marchese, N. (2017). FinTech is Shopping for New Ways into E-Commerce. Retrieved from https://medium.com/@fordhamfintech/fin-tech-is-shopping-for-new-ways-into-e-commerce-a3dd13a5d8e3

Singapore, South Korea ink Digital Partnership Deal. (2020). Retrieved from https://sbr.com.sg/information-technology/news/singapore-south-korea-ink-digital-partnership-deal

Statistics Korea (2020). Trends in Online Shopping in August 2020. Retrieved from http://kostat.go.kr/portal/korea/kor_nw/1/1/index.board?bmode=read&aSeq=385424

Fast-Changing E-Commerce Trends In A Pandemic. (2020). Retrieved from https://theaseanpost.com/article/fast-changing-e-commerce-trends-pandemic

The Impact of Fintech on eCommerce. (2017). Retrieved from https://www.lendfoundry.com/the-impact-of-fintech-on-ecommerce/

Waldeck, Y. (2020). Internet Users in South Korea. Retrieved from https://www.statista.com/statistics/432145/internet-users-in-south-korea/

Waldeck, Y. (2020). Smartphone Penetration as Share of Population in South Korea 2015-2025. Retrieved from https://www.statista.com/statistics/321408/smartphone-user-penetration-in-south-korea/

Yendamuri, P., Keswakaroon, D., & Lim, G. (2020). How Covid-19 Is Changing Southeast Asia’s Consumers. Retrieved from https://www.bain.com/insights/how-covid-19-is-changing-southeast-asias-consumers/

Zheng, J. (2020). SARS-CoV-2: an Emerging Coronavirus that causes a Global Threat. International Journal of Biological Sciences, 16(10), 1678–1685. Retrieved from https://doi.org/10.7150/ijbs.45053